Warren Buffett, widely known as the “Oracle of Omaha,” is one of the most successful investors of all time. Born on August 30, 1930, in Omaha, Nebraska, he built a vast fortune through value investing and strategic acquisitions. Despite his immense wealth, Buffett is known for his modest lifestyle and significant philanthropic efforts, pledging to donate nearly all his wealth to charitable causes.

Early Life and Education

Buffett was born into a financially knowledgeable family; his father, Howard Homan Buffett, was a U.S. congressman. From an early age, Buffett displayed an aptitude for business and investing. By the time he was a teenager, he had already experimented with multiple small businesses, including selling newspapers and pinball machines.

He attended the University of Nebraska, earning a degree in business administration. After that, he pursued further education at Columbia University, where he studied under Benjamin Graham, the father of value investing. Graham’s investment philosophy profoundly influenced Buffett’s approach to stock market investments.

The Rise of Berkshire Hathaway

Taking Control of Berkshire Hathaway

In 1956, Buffett returned to Omaha and launched Buffett Partnership Limited (BPL). By 1962, he began investing in a struggling textile company, Berkshire Hathaway. By 1965, he had acquired a majority stake and took control of the company. However, recognizing that the textile business was declining, Buffett gradually transformed Berkshire Hathaway into a massive holding company with investments in multiple industries.

Investment Strategy and Business Model

Buffett’s investment approach revolves around value investing—identifying companies with strong fundamentals that are undervalued by the market. Under his leadership, Berkshire Hathaway shifted its focus to acquiring high-performing businesses and holding substantial shares in major corporations.

Berkshire Hathaway operates in various sectors, including:

- Insurance: Acquisitions of GEICO and General Reinsurance helped solidify Berkshire’s presence in the insurance industry.

- Retail and Consumer Goods: The company owns Dairy Queen, Fruit of the Loom, and Benjamin Moore.

- Railroads and Transportation: In 2010, Buffett made a significant move by acquiring Burlington Northern Santa Fe Railway.

- Technology and Financial Services: Berkshire has substantial investments in Apple, American Express, and Bank of America.

Stock Market Success

From the 1960s through the 1990s, while the stock market’s major indices grew at an average rate of 11% annually, Berkshire Hathaway’s stock price surged by 28% per year. This remarkable growth made Buffett one of the wealthiest individuals in the world. Despite his massive fortune, he has remained humble, avoiding lavish spending and emphasizing long-term value over short-term profits.

Major Investments and Financial Decisions

Buffett has made several strategic investments that have significantly influenced the market. Some of his most notable financial decisions include:

- The 2008 Financial Crisis: During the subprime mortgage crisis, Buffett invested $5 billion in Goldman Sachs, a move that was initially questioned but ultimately proved highly profitable.

- General Electric Investment: Berkshire Hathaway invested $3 billion in General Electric, which also resulted in significant returns.

- Apple Stock: Buffett, historically hesitant about tech stocks, made a significant investment in Apple in 2016, which became one of Berkshire’s most valuable holdings.

Philanthropy and the Giving Pledge

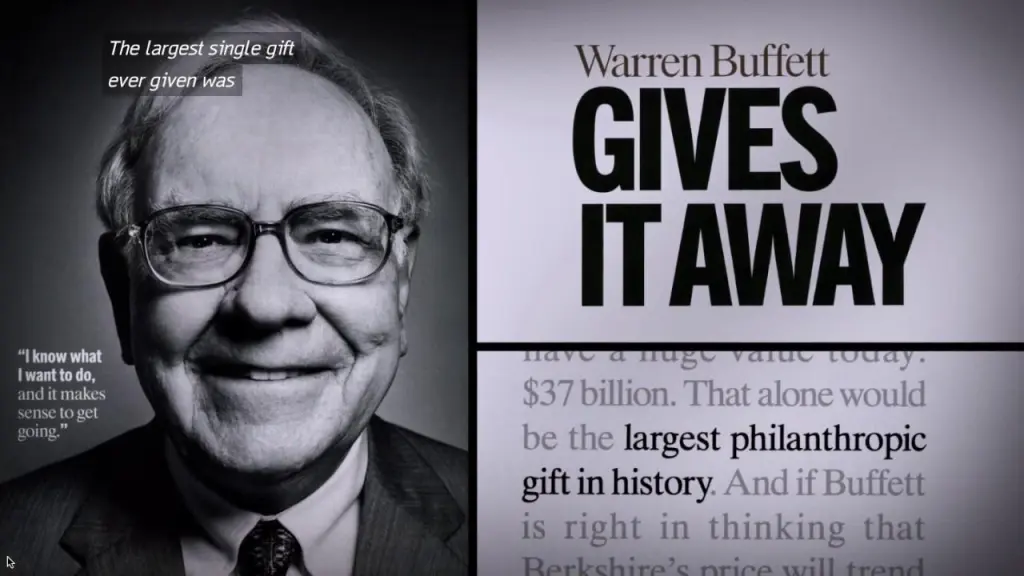

Massive Charitable Donations

Despite accumulating immense wealth, Buffett has consistently advocated for charitable giving. In 2006, he announced plans to donate over 80% of his fortune to various foundations. By 2020, he increased this pledge to 99%. His primary beneficiary has been the Bill & Melinda Gates Foundation, which focuses on global health, poverty reduction, and education.

Other organizations benefiting from Buffett’s philanthropy include:

- The Susan Thompson Buffett Foundation: Named after his late wife, it supports education and women’s reproductive rights.

- Foundations Run by His Children: Each of his three children manages a charitable foundation that receives funding from Buffett’s donations.

The Giving Pledge

In 2010, Buffett co-founded the Giving Pledge with Bill and Melinda Gates. This initiative encourages billionaires to commit at least half of their wealth to philanthropic causes. Many of the world’s wealthiest individuals, including Mark Zuckerberg and Elon Musk, have since joined the pledge.

Recognition and Influence

Buffett’s influence extends beyond finance. In 2011, he was awarded the Presidential Medal of Freedom by President Barack Obama for his contributions to the economy and philanthropy. He is widely respected for his financial acumen, ethical business practices, and advocacy for fair taxation policies.

Personal Life and Modest Lifestyle

Despite his immense wealth, Buffett has maintained a remarkably simple lifestyle. He still lives in the Omaha home he purchased in 1958 for $31,500. He enjoys simple pleasures such as eating at McDonald’s, drinking Coca-Cola, and playing the ukulele.

Buffett married Susan Thompson in 1952, and they had three children: Susan, Howard, and Peter. Though they separated in 1977, they remained legally married until her passing in 2004. In 2006, Buffett married Astrid Menks, his longtime companion.

Notably, Buffett is not known for extravagant spending; he prefers practical investments over luxury. His philosophy revolves around long-term value and prudent financial decisions.

Net Worth and Earnings

As of 2025, Warren Buffett’s net worth exceeds $100 billion, solidifying his position as one of the wealthiest individuals in the world. His fortune primarily stems from his ownership and leadership of Berkshire Hathaway, a multinational conglomerate with diverse investments in industries such as insurance, railroads, energy, and consumer goods.

Unlike many billionaires who accumulate wealth through technology or startups, Buffett’s success is built on long-term value investing, acquiring undervalued companies, and holding onto high-performing stocks for decades. Despite his immense wealth, Buffett is known for his frugal lifestyle, living in the same Omaha home he purchased in 1958 and driving modest cars. Additionally, he has pledged to donate 99% of his fortune to philanthropic causes, primarily through the Bill & Melinda Gates Foundation and the Giving Pledge, which he co-founded to encourage other billionaires to give away most of their wealth.

Final Words

Warren Buffett’s journey from a young entrepreneur in Omaha to one of the most successful investors of all time is nothing short of extraordinary. His disciplined investment strategy, business acumen, and commitment to philanthropy have made him a role model for aspiring investors and business leaders. His legacy is not only defined by financial success but also by his dedication to giving back to society.

Frequently Asked Questions

1. What is Warren Buffett’s net worth?

As of 2025, Warren Buffett’s net worth exceeds $100 billion, making him one of the richest individuals in the world.

2. What is Warren Buffett’s investment strategy?

Buffett follows a value investing strategy, which involves buying undervalued companies with strong fundamentals and holding them for the long term.

3. How much has Warren Buffett donated to charity?

Buffett has pledged to donate 99% of his wealth, with the majority going to the Bill & Melinda Gates Foundation and other philanthropic causes.

4. What companies does Berkshire Hathaway own?

Berkshire Hathaway owns numerous businesses, including GEICO, Dairy Queen, BNSF Railway, and Benjamin Moore, and holds large stakes in Apple, Coca-Cola, and American Express.

5. What is Warren Buffett’s lifestyle like?

Despite his immense fortune, Buffett lives a simple life, residing in the same Omaha home since 1958 and maintaining frugal spending habits.